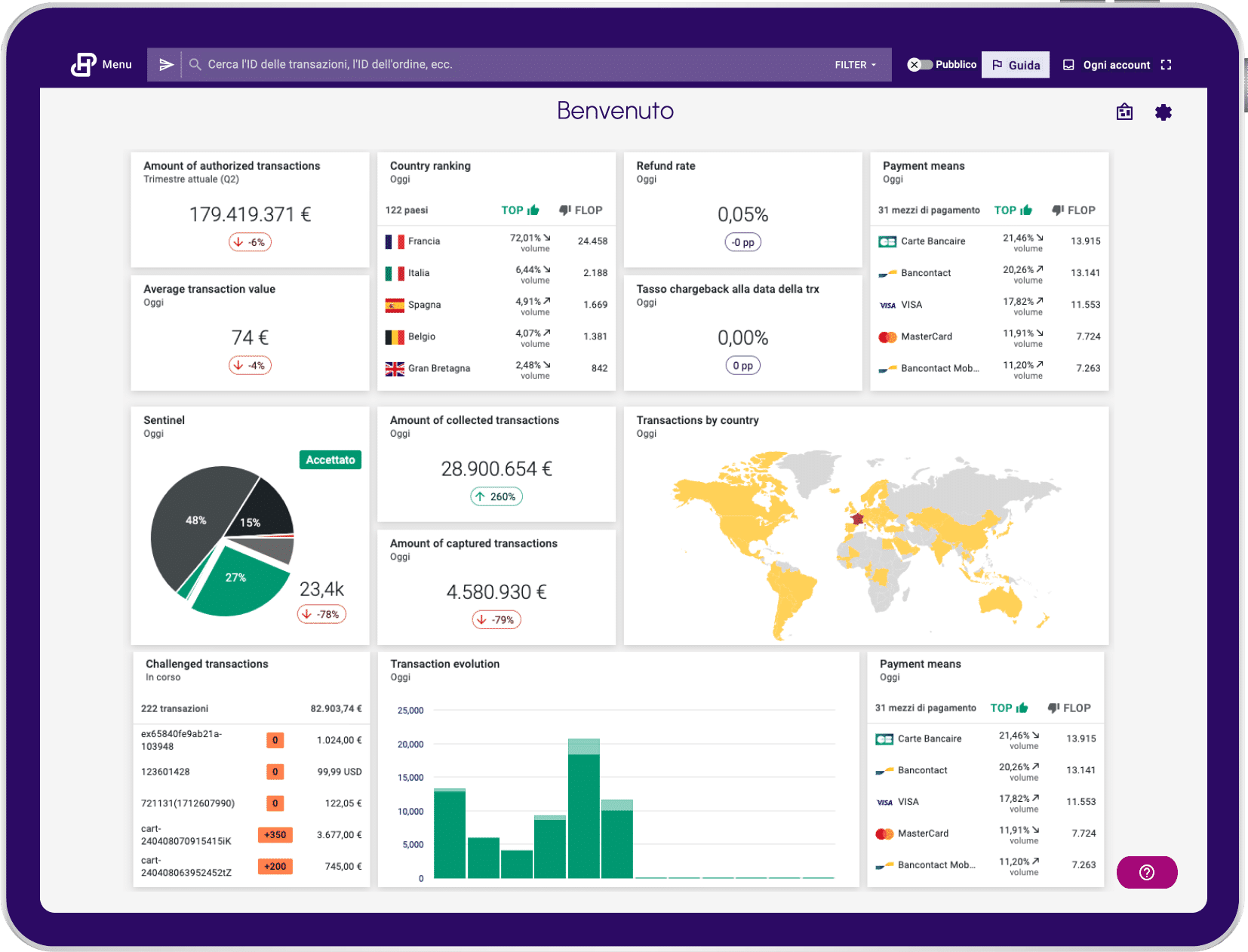

Gain a complete overview of your business

Segment customers and users

Improve your conversion rate

Track your transaction lifecycle

Analyze purchasing habits

Optimize fraud management

A unique business intelligence tool

Our management interface combines the power of your customer data with our responsive technology.

Your data, the core of your business

Through in-depth analysis of payment data, the quality of your purchasing experience becomes crystal clear. You can optimize it as you go along and use HiPay Intelligence to seize new opportunities.

Understand and manage transaction lifecycles

Quickly identify technical difficulties

Measure the impact of anti-fraud rules

Remove obstacles to conversion

Provide a tailored payment process

Know which campaigns have increased retention

Anticipate your customers' next purchases

Over 50 reports to help you take strategic decisions

Take your omnichannel strategy to the next level

At HiPay, we don't just process payments, we make them more efficient. How? By putting your customers at the core of your business through an enhanced payment experience.

- Unify your online and in-store payments

- Augment the purchasing experience

- Centralize all your payment data

In-store payments

In-store payment (by credit / debit card, in cash, etc.)

Queue boosting

Order-In-Store

Online payments

Online refund

E-commerce purchase

Pay-by-link

Omnichannel payments

One-hour Click-and-Collect

E-reservation

Ship-from-Store

Ready to leverage your payment data?

With augmented payments, offer enhanced customer experiences

Discover innovative ways to drive growth for your business

Meet our experts

Our team of experts is here to answer all your questions related to payment management and to deliver insights on your specific business

Discover our cutting-edge technology

Book a demo to learn more about our tools and payment solutions