Bizum, the most widely used mobile payment solution in Spain

Launched in 2016, Bizum has become the most widely used mobile payment solution in Spain. Today, more than 30 million users—around 60% of the population in Spain—make payments directly from their bank’s mobile app.

Bizum is natively integrated into participating banks' apps, allowing users to send and receive money using just a phone number.

This payment solution is based on an Account-to-Account (A2A) model: payments are made directly from one bank account to another, without relying on international card networks.

Transactions are secure and compliant with the highest banking standards, including Strong Customer Authentication (SCA) via biometrics or PIN code, in compliance with PSD2, and are processed through SEPA Instant Credit Transfers (SEPA SCT Inst).

What is Bizum?

Bizum is a Spanish mobile payment method operated by Bizum SL, a company owned by a consortium of more than 30 Spanish banks (including Santander, BBVA, CaixaBank, Sabadell, and Bankinter).

Bizum allows users to:

- Send money between individuals (P2P)

- Pay online and in-store (QR code, payment request, payment link)

- Make donations to NGOs and charities

- Collect winnings from official lotteries (Loterías y Apuestas del Estado)

- Pay bills and taxes

Since its launch, Bizum has become a leading mobile payment solution in Spain:

- Over 4.5 billion cumulative transactions across all use cases

- More than €240 million in total e-commerce transaction value

- Over 100,000 merchants accept Bizum

- Around 3 million transactions per day1

How to pay with Bizum?

Online payments (e-commerce)

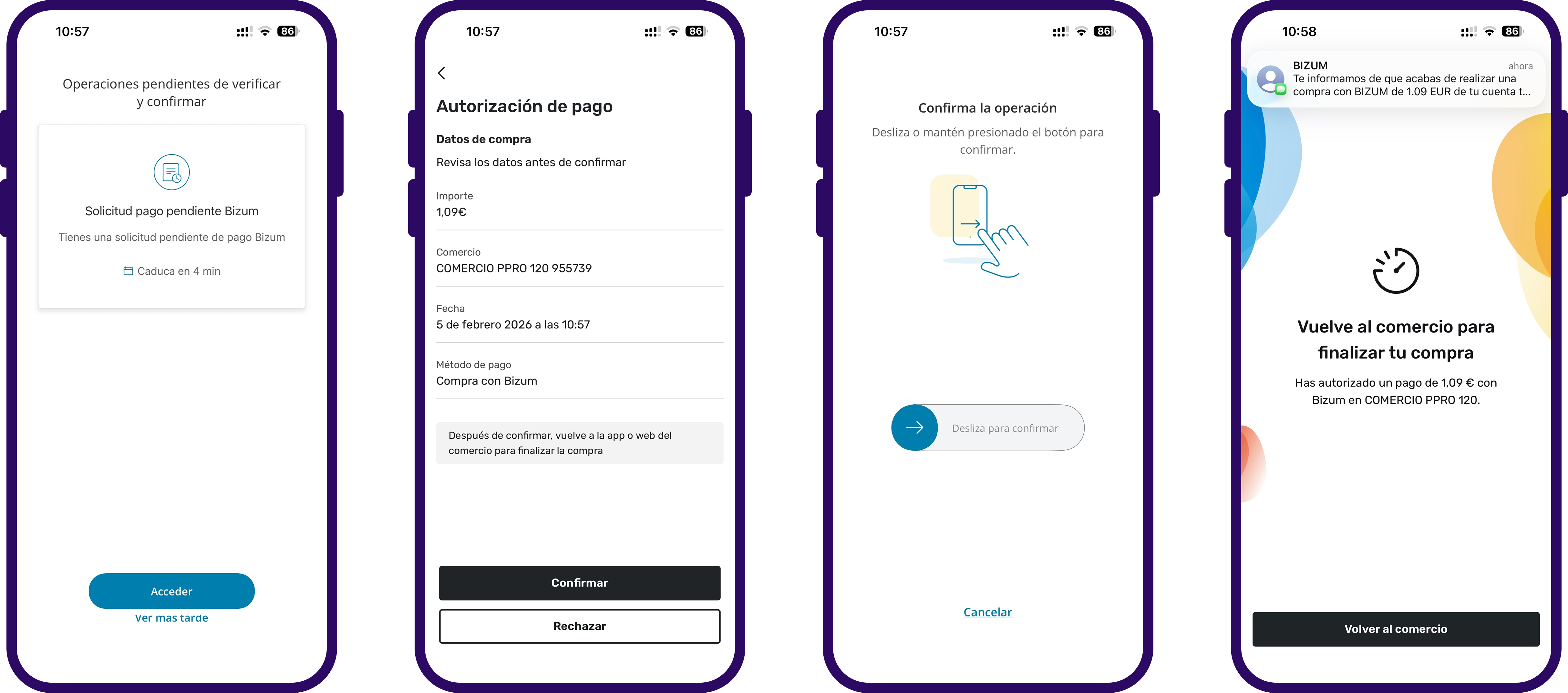

- The customer selects Bizum at checkout

- The customer enters their phone number

- The customer receives a push notification to approve the transaction in their banking app

- The customer validates the payment using biometrics or a PIN code

Online stores offering Bizum: https://bizum.com/es/comercios-online/

For in-store payments: two options

1) Via QR code

- The customer scans a Bizum QR code displayed on the terminal

- The customer receives a push notification in their banking app

- The customer validates the payment using biometrics or a PIN code

2) Via payment link

- The merchant enters the sale amount and the customer’s phone number in their app and generates a payment request

- The customer receives a push notification inviting them to authorize the transaction in their banking app

- The customer validates the payment using biometrics or a PIN code

Person-to-person (P2P) payments

- The user selects Bizum in their banking app

- The user enters a phone number or selects a contact and specifies the amount

- The user clicks “send”: the payment is instant

Why Spanish customers prefer paying with Bizum

For many consumers in Spain, Bizum has become second nature. It is fast, simple, and deeply embedded in everyday life. Its popularity is driven by several key factors:

Instant transactions

A Bizum payment takes only a few seconds, making it especially convenient for everyday small payments.

Integration with banking apps

Bizum is directly integrated into the mobile apps of major banks in Spain. There is no need to download an additional app or create a separate account. This seamless integration simplifies adoption and reduces concerns about fraud or transaction issues.

Simplicity and ease of use

All that’s needed is the recipient’s phone number to send money—no IBAN or complex codes required. This significantly reduces friction compared to traditional payment methods.

Free for individuals

Person-to-person transactions are generally free, encouraging daily use, unlike some card payments or international transfers.

Social habits and everyday use

In Spain, group payments among friends (restaurants, shared gifts, split expenses) are very common. Bizum fits perfectly into these everyday use cases by making such interactions fast and frictionless.

Security and trust

Bizum transfers are secure and managed directly by banks. Users therefore do not feel they are entrusting their money to an unreliable third party, which reinforces trust.

All payments are centralized in the banking app:

- P2P payments

- E-commerce payments

- In-store payments

- Transaction history and tracking

This integration strengthens trust and simplifies budget management.

Fast, flexible, and secure payments

Bizum payments rely on SEPA Instant Credit Transfers, with near-instant confirmation. Spending limits are not tied to a card but to the rules defined by the customer’s bank, offering greater flexibility for higher amounts.

All transactions are validated through Strong Customer Authentication, in compliance with PSD2 (SCA – Strong Customer Authentication).

Massive and cross-channel adoption

Bizum is accepted by most major e-commerce brands in Spain and by a growing number of physical retailers. This widespread adoption allows consumers to use a single payment method for all their daily use cases.

Why should you offer Bizum?

Higher acceptance rates

Bizum payments, initiated directly from bank accounts, avoid declines related to card limits or expiration. Merchants therefore see a significant reduction in declined transactions. At the same time, Bizum combines simplicity and security by allowing transactions to be initiated with a phone number and validated via SCA.

Conversion optimization

With more than 28 million users, Bizum is a major conversion driver in the Spanish market. Offering a trusted local payment method reassures consumers and reduces cart abandonment.

Simplified data entry (phone number + bank validation) streamlines checkout and improves the mobile experience.

Irrevocable transactions

Once completed, a Bizum payment cannot be reversed. Based on SEPA Instant technology (SCT Inst), funds reach the recipient in under 5 seconds and are automatically debited from the sender’s account. The transaction is therefore immediate and irreversible, ensuring speed and security for merchants.

Cost reduction and improved cash flow

A2A payments via Bizum:

- Are processed quickly

- Reduce intermediaries

- Offer better visibility over financial flows

This enables merchants to optimize cash flow and reduce payment-related operational costs.

Alignment with local usage and customer loyalty

Bizum is deeply rooted in payment habits in Spain. Accepting it means:

- Meeting local customer expectations

- Strengthening brand credibility

- Differentiating yourself from international players less adapted to the market

Bizum: a local payment solution with a European vision

Although originally designed as a local payment solution, Bizum is now delivering on its European vision. A member of the EuroPA alliance alongside Bancomat Pay, Multibanco MB Way (SIBS), and Vipps MobilePay, the service reached a new milestone with the signing, on February 2, 2026, of a memorandum of understanding between EuroPA and the EPI (European Payment Initiative), the organization behind Wero.

This agreement aims to make participating solutions interoperable and enable cross-border payments—first for P2P transactions starting in 2026, followed by e-commerce and in-store payments from 2027.

In practical terms, this means that a French Wero user will be able to instantly send money to a Bizum user in Spain. Similarly, a French merchant offering Wero will be able to accept payments from customers using Bizum.

By adopting Bizum today, a European merchant is not limited to a Spanish solution: they align themselves with a scalable, secure system designed for future pan-European use.

Why integrate Bizum with HiPay?

A single, centralized integration

HiPay, a multilocal European payment service provider, enables merchants to access Bizum through a single integration, alongside other local and international payment methods.

Local expertise and strategic support

HiPay leverages proven expertise in deploying A2A payment methods across Europe, notably with MB Way in Portugal and Bancomat Pay in Italy. Its teams support merchants with:

- Technical integration

- Payment journey optimization

- Continuous performance improvement by market

HiPay also has a local team in Spain based in Madrid, composed of experts with in-depth knowledge of the technical, banking, and (e-)commerce ecosystem.

Conclusion

Integrating Bizum into your payment mix allows you to:

- Effectively reach consumers in Spain

- Improve conversion and user experience

- Reduce transaction costs

- Benefit from a secure, bank-integrated payment method that is widely adopted

In a context where local A2A payment solutions are becoming European standards, Bizum is a strategic lever for succeeding and accelerating your growth in the Spanish market.

Are you willing to integrate Bizum into your payment mix? Contact us!

1 Bizum, 2025